The stock market is richly valued on a fundamental basis, with the S&P 500 now trading north of 30x trailing earnings.

By comparison, the average price-earnings ratio for the index is just 22.8 over the past 10 years. But stocks have appeared to be overvalued for a while now.

That brings us to a time-honored investment principle I learned many years ago: valuation alone is a lousy guide for timing your buy and sell points.

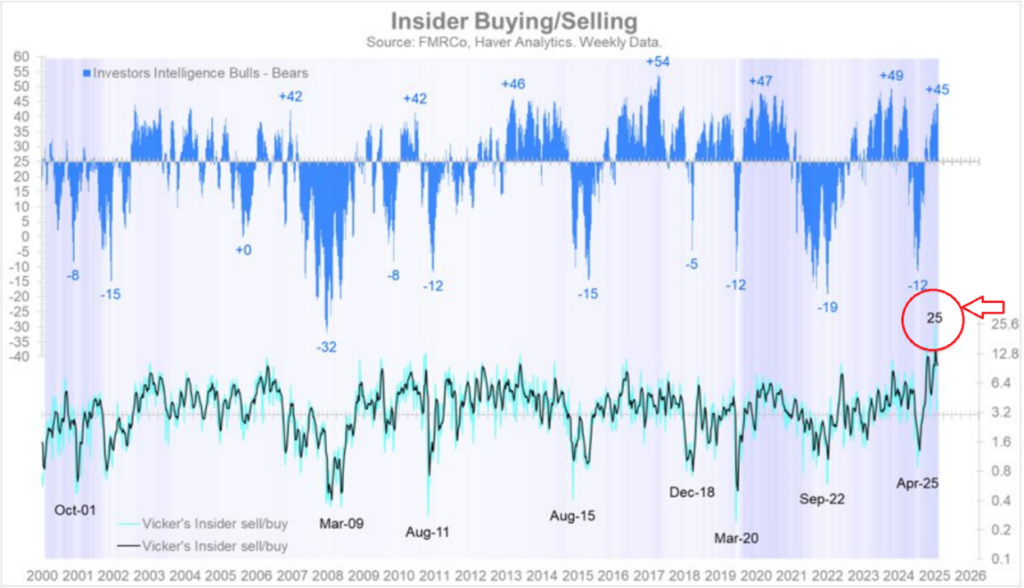

However, you can get actionable insights about market valuation simply by watching to see if the “big money” is buying or selling. And right now, we see a 25-year record high of insider selling.

That’s why I keep a watchful eye on what insiders and big hedge fund institutional investors are up to. These successful billionaires are often in the know, best positioned to take advantage of opportunities to buy or sell.

The key question is, “what they are doing with their own money?”

Are they putting their money where their mouth is and buying… or are they talking the talk… but quietly selling into market strength?

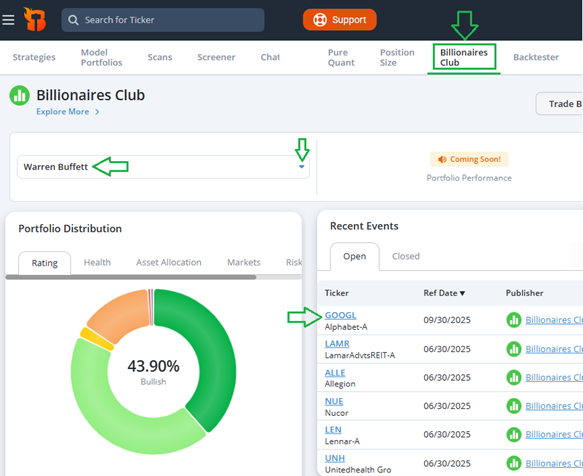

The media was abuzz this week when Warren Buffett’s Berkshire Hathaway revealed a new $4.9 billion stake in Google parent Alphabet (GOOGL) stock.

These Tradesmith Tools Can Give You Advanced Warning…

The tools I’m about to show you are exclusive to paid subscribers (you can get access right here if you don’t have it). But I wanted to give you a peek behind the curtain because at Tradesmith, we’ve made it so you can easily track the buying and selling of billionaire investors like Buffett who move markets.

Here’s how to do it…

From the main menu bar, click on Invest, then from the sub menu, Billionaires Club.

Click on the dropdown menu box to select the Billionaires Club member by name or scroll through the list of 40 successful billionaire investors we keep tabs on.

Under Recent Events you’ll find their latest open and closed positions, including Buffett’s new GOOGL buy.

So, if the Oracle of Omaha is willing to buy a stock like GOOGL at today’s rich valuation, then maybe tech isn’t in a bubble after all.

On the other hand, Wall Street insiders – the officers and directors of public companies – are selling their own stock right now like there’s no tomorrow.

In fact, as you can see above, the insider sell-to-buy ratio just hit a sky-high 25-to-1.

That’s the highest level of insider selling compared to buying since the dot.com bubble burst in 2000.

Considering all the chatter these days about rich valuations and a possible tech bubble, this 25-year record high for insider selling could be a bad omen for stocks.

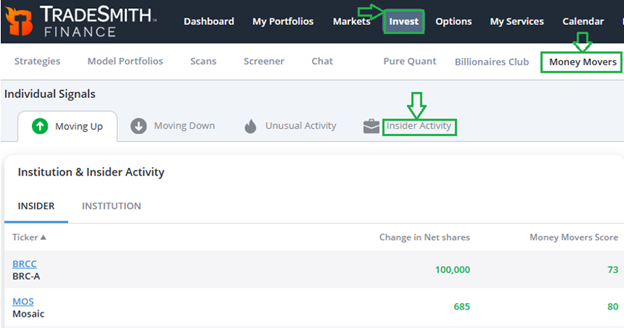

But if you want some advanced notice on this as well, Tradesmith’s Institution & Insider Activity tool tracks this.

Simply click on Invest, then Money Movers as shown above, and scroll down to the Institution & Insider Activity page and click on Insider Activity.

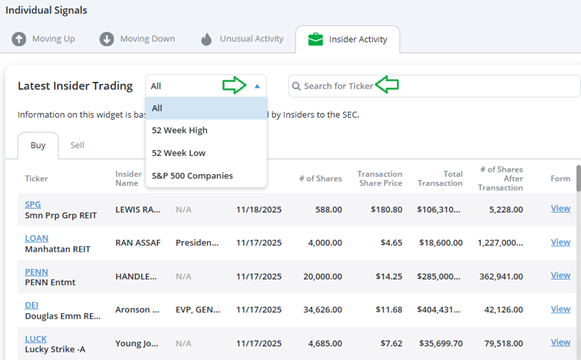

This will take you to the Latest Insider Trading page shown below. Here you can view all recent insider buys and sells. Or you can search for a specific stock by its ticker symbol.

This tool is currently only available to Tradesmith Platinum members. You can check out Platinum right here.

We regularly update this data as corporate insiders file new Form 4 disclosures with the Securities and Exchange Commission.

If you have access, it’s a good idea to check these lists periodically just to make sure any stocks that you own don’t show up on the insider selling list.

If you don’t, we’ll update you regularly on this list in future issues of Market Minute.

Bottom line: It’s true that corporate insiders may sell stock for all kinds of reasons. But when there’s an overwhelming amount of insider selling compared to buying – like there is today – that can send an important signal about market valuation. After all, the officers and directors of publicly traded companies are best positioned to know the prospects for their business and if their stock is overvalued.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

Managing Editor’s Note: Tradesmith has an incredible array of tools to help investors stay ahead in the stock market. Do you want to see more content like this? Let us know at [email protected].