It’s time to bet against the banks.

Bank stocks have enjoyed a fantastic run higher over the past several months. The KBW Bank Index (BKX) is up over 60% since bottoming last April. It has been leading the stock market higher.

Now though, the sector is overbought. And, just about all the stocks in the index are trading at the top of their historical valuation ranges.

This feels like a good time to add short exposure to the sector.

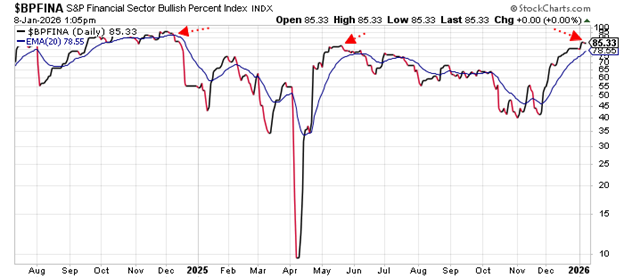

It’s also worth noting that the bullish percent index for the financial sector (BPFINA) is on the verge of generating a sell signal. Look at this chart of BPFINA…

A bullish percent index (BPI) shows the percentage of stocks in a sector that are trading in bullish technical patterns.

It’s an easy way to measure overbought and oversold conditions for a sector. Typically, a reading above 80 – meaning 80% of the stocks are trading in bullish technical patterns – means a sector is overbought. Readings below 30 indicate oversold conditions.

Buy and sell signals occur when a BPI reaches extreme levels and then reverses.

For example, when a BPI rallies above 80 and then turns lower it generates a sell signal. When a BPI dips below 30 and then turns higher, that’s usually time to buy. At least, those are the general rules.

The red arrows on the chart point to the two most recent BPFINA sell signals this. BKX declined 8% in three weeks following the sell signal in December 2024. It fell 4% in about one month following the sell signal last May.

The BPFINA is once again in an extremely overbought condition. And, when it turns lower, we’ll get another sell signal.

Given that the bank stocks are trading at their highest book value multiples since late-2021 – which was a bad time to buy bank stocks – the next sell signal is likely to kick off a larger decline. It looks to me like BKX could lose 10% to 15% over the next two months.

Traders should also keep in mind the action in banks tends to lead the action in the broad stock market. Just as the bank stocks have led the market higher since April, if the banks do indeed start to fall from here, the rest of the stock market will likely follow.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.