One by one, the lagging sectors of the stock market are starting to play “catch-up.”

It started with electric utility stocks like PG&E Corp. (PCG). One month ago, PCG was hitting new lows for 2025. Today, the stock is 20% higher.

That’s a solid gain for one month.

Then, the healthcare sector got in on the action. By the end of July, just about every stock in the sector was hitting multi-year lows. Today, spurred by news that major hedge funds have been buying into the sector, most healthcare names are up 20% or more since the start of the month.

And now, it looks like energy stocks are ready to rally.

Prior to Friday’s bump, the Energy Select Sector Fund (XLE) was unchanged for the year.

Yes, XLE had rallied about 11% off the early April low. But, that rally pales in comparison to the 28% gain in the S&P 500. And now, as money appears to be coming out of the high-flying technology and AI names and is flowing into the lagging sectors, the value-priced energy stocks look set to rally.

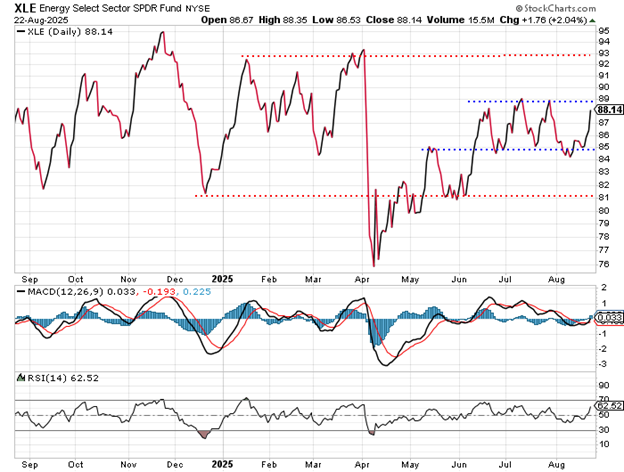

Take a look at this chart of XLE…

XLE has spent the past two months bouncing between $85 and $89 per share. This action has created a consolidating rectangle pattern on the chart. Since the rectangle is $4 high, any breakout from this pattern should ultimately lead to a $4 move in the direction of the break.

For example, if XLE breaks out to the upside, then the price target will be $93 per share – which lines up well with the January and March highs. A break to the downside targets $81 per share – which matches the December and June lows.

The MACD and RSI indicators at the bottom of the chart, which measure the momentum of the current action, are in neutral territory. They don’t indicate a preferred move in either direction. Though, in neutral, they indicate there is plenty of energy available to fuel a large move once it gets started.

Since energy stocks have been lagging the performance of the broad stock market, I favor an upside breakout for XLE. The stocks are cheap relative to the S&P 500. They’re due to play a game of “catch-up.”

It’s also worth noting the seasonal trend for energy stocks is bullish as we head into September. For whatever reason, the energy sector tends to bottom in August/September and then rally for several weeks heading into the fall months.

If that pattern holds true this year, many energy stocks could be sharply higher in the weeks ahead.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.