The stock market may have escaped its typical September slump. But warning signs continue to flash nearly everywhere you look telling me this extended rally is increasingly vulnerable to a reversal.

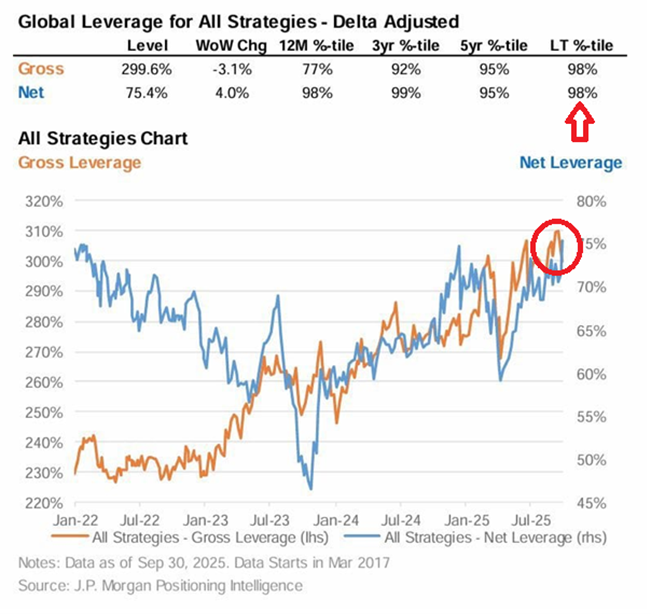

You can see the latest evidence for yourself in the chart below…

Hedge funds and other big money institutional investors are all in for stocks right now. And that’s not only true for the Nasdaq and S&P 500, but for stocks around the world.

Today, 94% of global markets are trading above their long-term trends, as measured by the 200-day moving average. Most are just as overbought as the S&P 500 Index.

It’s an extremely crowded trade on the long side not just here at home, but worldwide.

And not only are funds fully invested – but they’ve borrowed massive amounts of money to go long. Gross leverage (or borrowed money on margin) is above 300% today for all fund strategies worldwide.

That’s in the top 98% percentile of global fund positioning over the last decade or more. Put another way, funds are leveraged to the hilt more than ever, with little or no buying power remaining!

There simply isn’t much buying power left to push stocks even higher.

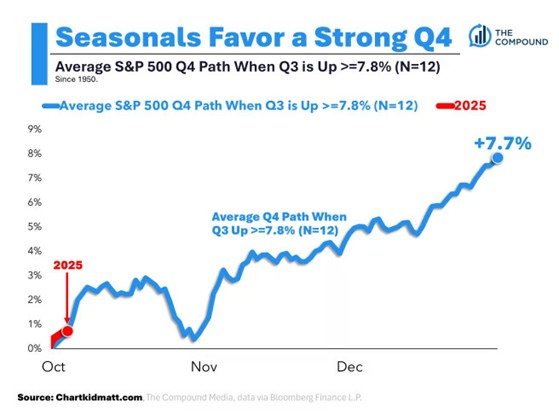

Sure, stock market seasonality has turned bullish, as you can see below. Investors worldwide anticipate the typical year-end rally. But not so fast.

The S&P 500 has gained nearly 8% on average from October through December historically.

But notice the pullback in stocks that typically starts right about now, with the market often experiencing a scary selloff in the weeks ahead that doesn’t bottom until around Halloween.

Bottom line: The market is certainly overdue for a pullback. So far stocks have defied gravity and stayed on course to the upside. Seasonality suggests we should see a strong year-end rally, but only after a mid-course correction in the weeks ahead. If so, any pullback may prove to be a good buy-the-dip opportunity.

Good investing,

Mike Burnick

Contributing Editor, Market Minute