Just in time for Halloween, investors got a spooky message from a haunting stock market indicator last week.

Last Wednesday, a Hindenburg Omen flashed a warning of a potential stock market scare. Oh, the humanity!

What is it and just how worried should I be?

First, a Hindenburg Omen happens when there is an unusually high number of stocks hitting new yearly highs and yearly lows plus other negative market breadth measures all happening at the same time.

It’s considered a sign of stock market instability, with some stocks marching to new highs, while others are falling by the wayside.

And sure enough, stock market breadth has been deteriorating lately.

The number of new lows relative to new highs has been rising for several weeks in the S&P 500 and Nasdaq 100.

Plus, the number of stocks trading above their 50-day price moving average line has been declining steadily for several months now on multiple indexes, including the NYSE, S&P 500 and Nasdaq. (Jeff wrote about this last week.)

That is not the kind of underlying weakness you would expect to see as the S&P 500 closes in on the 7000 mark.

Second, the Hindenburg Omen has preceded some significant market crashes, like October 1987. Overall, it has a mixed track record, frequently generating false negative signals.

But taking a closer look at the recent history of this indicator, it tells me to consider taking a more cautious investment stance over the next few months.

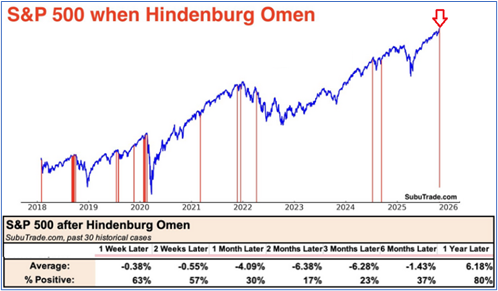

As you can see above, average returns skew heavily negative in the two to three months after the signal flashes, based on the last 30 instances.

Returns for the S&P 500 two to three months after the signal are -6.3% on average, with stocks up only about 20% of the time.

And it takes about a year after the signal for stocks to fully recover.

The Hindenburg Omen did flash several times ominously, just before the 2020 pandemic market meltdown, and again in late 2021, just before the 2022 bear market.

Bottom line: Stocks are in the typical seasonal sweet spot into year end, but they’re also extremely overbought right now. That’s why a market correction sometime in the next few, typically bullish months, would be a sinister setup that catches many folks off guard.

Good investing,

Mike Burnick

Contributing Editor, Market Minute