Don’t look now, but investor greed is moving into the danger zone again for stocks. At the very same time, the market’s fear gauge, the Volatility Index (VIX), is ticking higher along with stock prices.

That’s a bad combination, which in the past, has often led to stock market corrections.

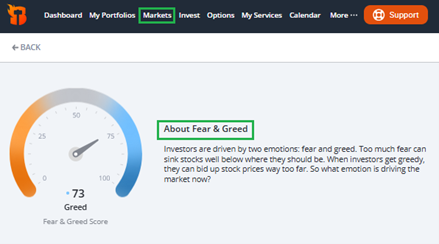

You can see above that our TradeSmith Fear & Greed indicator (found on the Market Outlook page) is ticking higher again. The current reading near 75 isn’t signaling extreme greed just yet.

But, three out of the seven sub-components of the indicator are registering extreme greed, and another two components are now signaling “greed.”

Also, institutional investors are once again displaying an all-in risk on attitude, by throwing caution to the wind to get leveraged long the stock market.

The National Association of Active Investment Managers (NAIIM) publishes a weekly exposure index that tracks the investment allocation of professional money managers nationwide.

The current reading (far right, top panel) is near 90, but just a few weeks ago it reached the highest level in months at 100.7. That means money managers are not only fully invested but also long on margin to lift their allocation above 100%.

In the lower panel of the chart above is the S&P 500 Index, and you can see that extreme highs at or above 100 in the NAIIM index line up almost exactly with stock market corrections in the past.

Bottom line: Stock market seasonality remains bullish right now, according to our Trade Cycles timing indicators. But seasonality often turns negative by springtime of mid-term election years, which includes 2026. That’s why it’s a good idea to keep an eye on market sentiment indicators, like our Fear & Greed index.

When they hit extremes, that’s the time to consider lightening up on your investments.

Good investing,

Mike Burnick

Contributing Editor, Market Minute