Roughly two-thirds of S&P 500 companies have now reported their latest quarterly results, and once again they’re beating expectations.

That’s the good news. The potential bad news is that it’s just a handful of companies that account for all the profit growth.

Plus, we’re getting closer to “as good as it gets” for future S&P 500 earnings growth.

First, let’s look at the results.

With 293 S&P 500 companies having reported earnings so far, 77% have beaten analyst estimates, and by an average of 7.6% above forecasts.

The results are on track for +13% earnings growth year over year for the S&P 500.

On the other hand, just five of the 11 S&P 500 sectors are reporting increased net profit margins, which is the real bottom line. Another four sectors have shrinking profit margins, while two have flat margins.

And I bet you can guess which sector is doing ALL the heavy lifting in terms of both profit growth and margin expansion… you guessed it, technology.

Tech sector profit growth alone is on track to jump more than 30% year over year.

Profit margins are tracking a 29% growth rate, compared to just 13.2% for the S&P 500 overall.

Excluding the tech sector’s $139 billion in quarterly profits, S&P 500 earnings growth would be negative year over year.

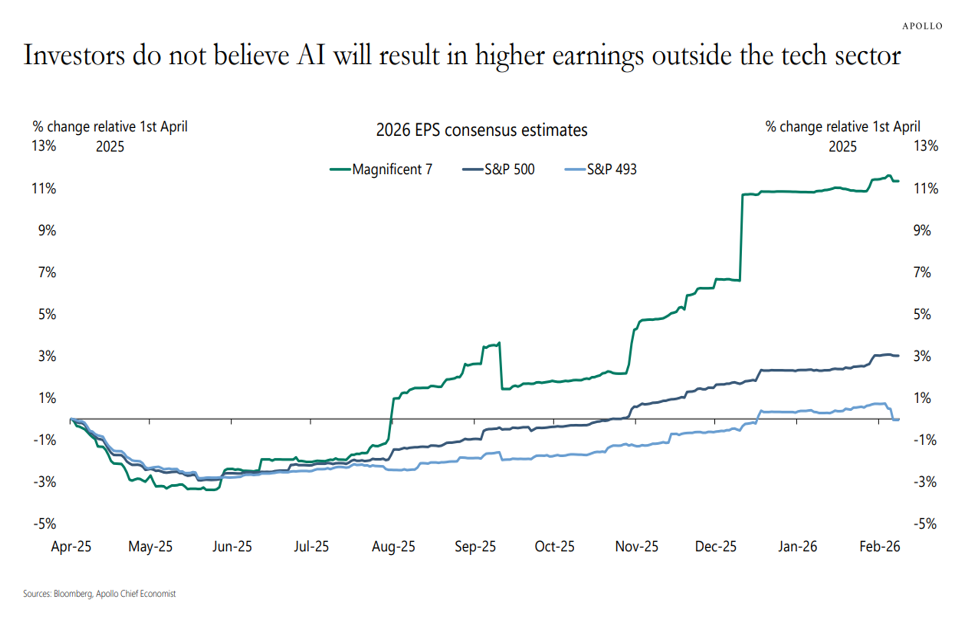

And as you can see in the chart above, the profit story doesn’t get any less lopsided for 2026 results either.

- Wall Street’s earnings estimate for full year 2026 is up just 3% for the S&P 500 overall since April 2025.

- Meanwhile, the Mag 7 stocks have witnessed a 12% increase in expected 2026 profits, or four times

- There has been NO increase in expected earnings for the rest of the S&P 493 (ex-Mag 7).

In other words, earning growth prospects are as flat as a pancake for the average stock in the index.

This tells me that investors simply aren’t buying into the “AI will magically transform everything” story.

Sure, big tech stocks are capitalizing on the AI craze, at least for now. But they are also spending ever increasing sums to buy that growth, estimated at about $2 billion per day in capital investment.

That’s on track for a staggering $650-$700 billion this year alone.

Folks, that’s more than 10 times what the US spent to put a man on the moon during the 1960s and early ‘70s!

Meanwhile, AI-generated profits outside of the tech sector, for the rest of the S&P 500, are proving to be elusive at best.

So far, Mag 7 stocks are hitting paydirt, and it shows in their bottom line. But those results may be as good as it gets, or very close to it.

Meanwhile, what about the rest of the S&P 500 stocks; when (if ever) does the promise of AI riches hit the bottom line for these companies?

Good investing,

Mike Burnick

Contributing Editor, Market Minute