Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Slowing Growth and Rising Prices, That’s Stagflation!

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Washington’s beltway bureaucrats just can’t catch a break these days.

It’s bad enough that thousands of government workers received pink slips from the former duke of DOGE in recent months…

But the beltway bean counters still on the job just can’t seem to get the numbers right.

We’re all shocked to find the most recent employment report may have been “rigged” to show far fewer job gains than previously reported. And the bearer of that bad news was quickly handed a pink slip, too.

Instead of “the dog ate my homework” excuse, the pooch apparently gobbled up 245,000 jobs while nobody was looking.

Bad girl, you’re fired!

Or perhaps the real answer is that our economy is slowing a bit more than we all realized as tariffs put upward pressure on costs for consumers and businesses alike.

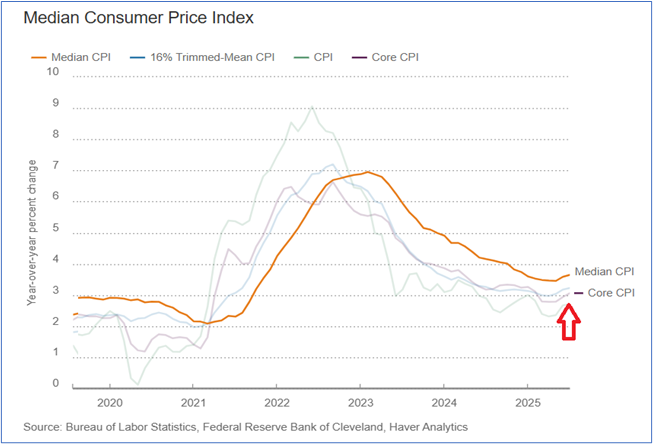

That’s why the spotlight was on this week’s Consumer Price Index (CPI) report. And markets cheered when headline CPI was unchanged at +2.7% year over year.

Core CPI jumped more than expected at +3.2% year over year up from 2.9% previously.

Even worse, median CPI at +3.6% last month (shown above) continued its upward trend.

The median CPI measure may be a better gauge of rising prices, since it excludes outliers (both small and large changes) from the noisy monthly data to focus on the underlying inflation trend.

And the trend in all the various inflation measures are clearly moving in the wrong direction… UP!

Taken together, slowing job growth and rising prices is a recipe for stagflation.

That’s a toxic brew of slowing growth plus rising inflation. And it cuts into both consumers’ spending power and corporate profit margins.

And it’s already a bigger threat to corporate profits.

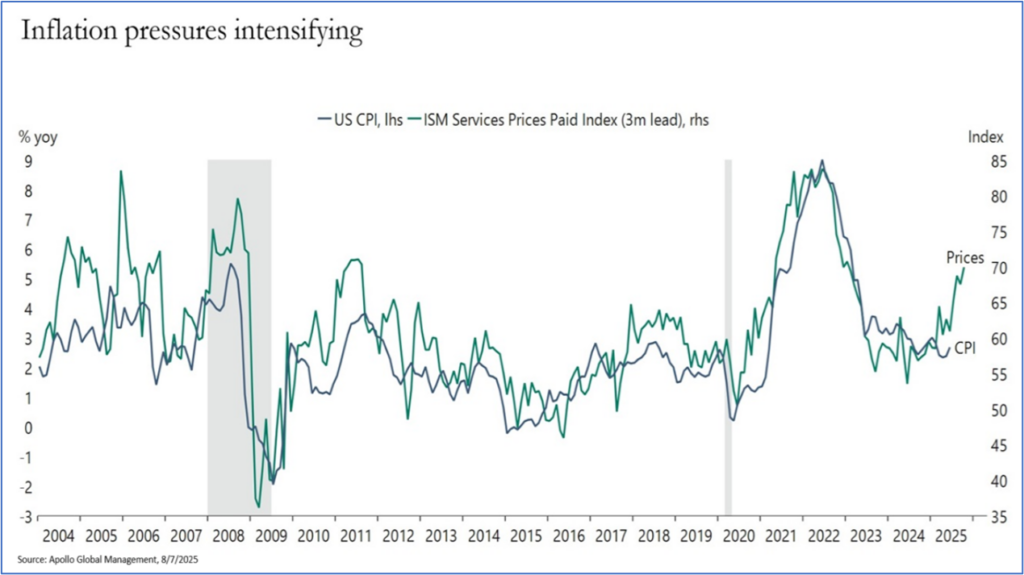

Prices paid by American manufacturing and service-sector businesses have surged more than 15% higher since the start of the year, as shown above.

According to a Goldman Sachs report, American consumers have paid just over 20% of the new tariff costs so far.

Meanwhile, U.S. business have swallowed 64% of the price increase, in order to avoid consumer sticker shock, while foreign exporters (the intended target of tariffs) have paid just 14%.

But shoppers, brace yourselves, because Goldman expects companies to pass along the price increases during the second half of this year, with consumers eventually paying nearly 70% of higher costs due to tariffs.

Bottom line: Stagflation is just another (of many) clear and present dangers to the U.S. economy, and especially to the ongoing stock market rally.

Good investing,

Mike Burnick

Contributing Editor, Market Minute