Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Some Stocks Are in a Bear Market, But Others Not at All

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Is this a bear market? Well, yes and no.

The truth is most of this market selloff is due to just a handful of stocks. While the “average” stock in the market is far from bear market territory.

It’s true that the Nasdaq 100 Index and Russell 2000 small caps are in a bear market already, generally defined as a decline of 20% or more.

Anything less is generally considered a correction.

And so far, the blue-chip S&P 500 Index and Dow Jones Industrials have avoided bear market territory. As of last week’s close, the S&P 500 is down -18.9% on a closing basis from its all-time high in February.

That’s close, but no bear market cigar just yet. Meanwhile, the Dow has held up even better, down -16.5% so far.

But the S&P 500 decline sounds worse than it is… if you focus on where most of the damage has really been done. And that would be the overhyped Magnificent 7 stocks.

Just take a closer look.

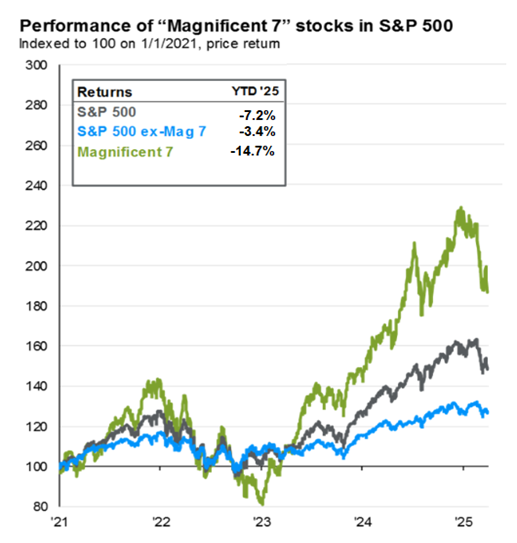

This chart focuses on year-to-date performance, and by that measure you can see the S&P 500 is down 7.2% since December 31.

But the rest of the S&P 500 – excluding the Mag 7 – is down just 3.4%.

Most of the pain investors feel has been inflicted by the Magnificent 7 stocks, which are collectively down 18.8%.

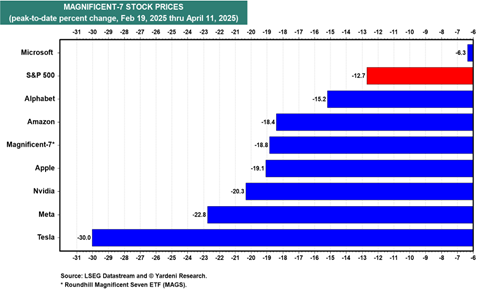

Tesla is by far the leading pain-giver, down 30%. Perhaps Elon Musk should stick to EVs and space travel.

But all of the Mag 7 have taken a beating to some degree, except Microsoft, which is down only 6.3%.

Indeed, the S&P 500 technology sector is down 17.7% since the selloff began, and was down 25.8% at the recent low.

Of course, these stocks were trading at nose-bleed valuations prior to the recent peak. This was always unsustainable and just waiting to ignite.

Tariffs were the match to burn their premium valuation down.

Mike Burnick’s Bottom Line: This correction – or bear market if you will – has been mostly about the expensive, overhyped stocks coming back to earth in terms of valuation. Meanwhile, the “average” stock has barely experienced more than a mild pullback in price. And that tells me the overall stock market should be able to bounce back quickly, once the tariff trauma has passed.

Good investing,

Mike Burnick

Contributing Editor, Market Minute