Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

The Latest Threat to Stocks: Employment Growth Stalls Out

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

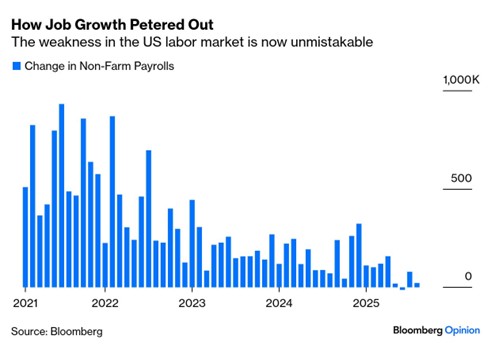

Here’s a new danger to the economy and stock market that you can add to the list: job growth has flatlined.

Last Friday’s employment report showed just 22,000 new jobs added last month, less than one-third of what was forecast, meanwhile the unemployment rate ticked up to 4.3%.

But that’s not the half of it…

The real bad news for jobs landed with a crash yesterday. The Bureau of Labor Statistics revised down the payroll data for the past year ending March 2025 showing 911,000 fewer job gains than previously reported.

It was the largest revision to “official” government employment data in 13 years. And just like that, nearly a million jobs went poof.

Investors now realize that job growth, a key indicator of economic health, has throttled down to stall speed. And this isn’t likely to be a one-off shock either…

Here’s Why

First, small business owners are flagging poor sales as the biggest issue they face today. That’s mainly due to the high level of economic uncertainty.

This has been a consistently good leading indicator pointing to a higher unemployment rate to come.

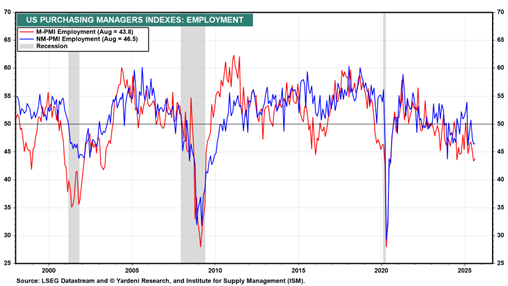

Second, big corporations are likewise warning of decreased jobs. Employment indexes for both manufacturing and service sector businesses are contracting… and have been for months.

A slowdown in hiring activity is typically seen as a precursor to layoffs and a rising unemployment rate in the months ahead.

This slowdown in employment is widespread. And not surprisingly, it’s weakest in the sectors most impacted by tariffs. In fact, job growth has gone negative in cyclical industries including manufacturing, construction, retail, and transportation.

Bottom line: Thanks to huge revisions in the unreliable government data, the U.S. labor market is much weaker than previously thought. And real time indicators from both large and small businesses tell me employment will continue to decline.

Good investing,

Mike Burnick

Contributing Editor, Market Minute