Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

This Rally May Be Living on Borrowed Time

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Stocks have enjoyed one heck of a rally since the April tariff turmoil lows, but several sentiment indicators we follow closely tell me that this rally may be living on borrowed time….

Remember, sentiment indicators are read as “contrary” indicators. For example, when there are too many bulls… that’s bearish for stocks, and vice versa.

And on that note, you can see below that stock market greed has returned with a vengeance.

Our Fear & Greed Index is back to an Extreme Greed reading at 83. That’s the highest reading in over a year and among the highest levels in recent years.

From a contrarian perspective, this is bad news, because such high greed readings in the past often lead to stock market corrections.

Greed is not always good!

But it’s not only retail investors that are head-over-heels in love with the TACO trade. Wall Street pros are all-in on the bullish bandwagon, too.

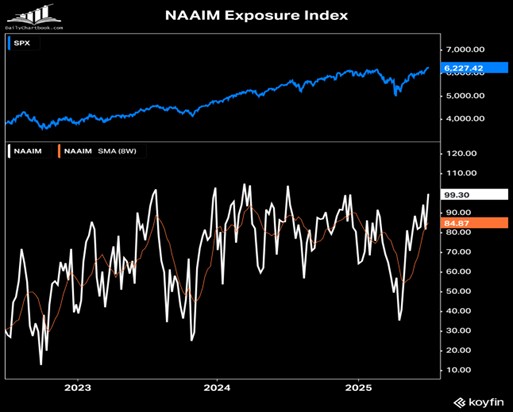

Data from the National Association of Active Investment Managers (MAAIM) shows the highest level of allocation to stocks among Wall Street pros in more than a year, as shown below.

Once again, this has been a reliable contrary indicator in the past.

You can see for yourself that high NAAIM readings (lower panel) have lined up with peaks in the S&P 500 Index (top panel).

Okay… so sentiment is stretched near a bullish extreme. But what will be the catalyst to trigger a reversal for stocks?

While it could be almost anything unexpected, our in-house TradeSmith Seasonality indicators are forecasting a reversal of fortune for stocks could be dead ahead.

July is so far living up to its typically bullish seasonality profile. But data on market seasonality says to expect a reversal to a bearish timing trend in just a few weeks.

Seasonality for the S&P 500 during post-election years since 1953 takes a bearish turn from August 1 to the end of September. During this time frame, the S&P has declined -2.61% on average and is down 55.56% of the time in post-election years.

Mike Burnick’s Bottom line: I certainly hope you’ve enjoyed and profited from the stock market surge since April. Enjoy it while it lasts, because a less favorable seasonal period is just ahead. Plus, reliable contrary sentiment indicators are signaling trouble ahead, too. And that’s a recipe for a likely market correction. The good news is that seasonality turns positive again in October, so any pullback should be a good buying opportunity.

Good investing,

Mike Burnick

Contributing Editor, Market Minute