After three weeks of turbulent action in the stock market, the bulls finally have some good news. One of our most reliable, short-term technical indicators has turned bullish.

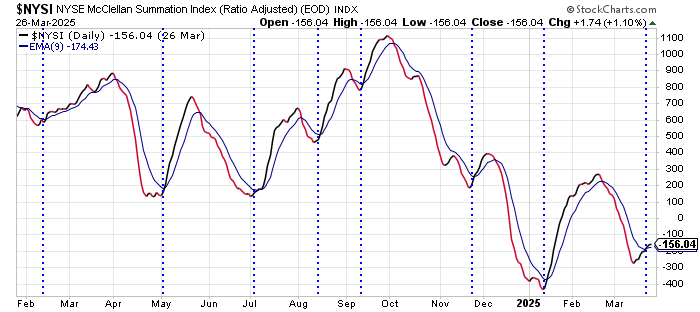

The Summation Index for the NYSE flipped to a buy signal earlier this week. Take a look…

This Summation Index is another technical tool for measuring market momentum.

Whenever the NYSI rallies above its 9-day EMA (the squiggly blue line on the chart), it indicates that momentum is turning higher – and that’s usually a good time to buy stocks.

Whenever the NYSI falls below its 9-day EMA, momentum is waning. That’s usually a good time to sell.

The blue dashed lines on the chart show the buy signals over the past year. Here’s how those buy signals lined up with the S&P 500…

All seven of the previous NYSI buy signals led to an immediate rally in the stock market.

The rallies last August and November were quite mild – just over 100 S&P points, and lasting only a few sessions. But the declines last May and September – coinciding with similar oversold conditions to what we’re seeing today – were more significant.

There is no way to know if the current NYSI buy signal will lead to a small rally or a large one. Heck, it might even lead to the market just marking time for a few sessions before stocks start to decline again – like they did following the buy signal in January.

So, I’m not suggesting folks throw all their money into the market and take a full 100% long trade.

I am suggesting, however, that rather than getting caught up in the wave of selling pressure, folks might want to start putting some money to work here. NYSI buy signals have a good track record.

So, until this one is negated – with the NYSI closing back below its 9-day EMA – it is possible, even likely, the decline over the past few days is a bear trap – designed to shake traders out of long positions before the market makes a move higher.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

READER MAILBAG

Do you agree with Jeff and think it’s time to start putting money to work? Let us know right here.

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.