Growth is crushing value.

Stocks like Nvdia (NVDA), Broadcom (AVGO), and Palantir (PLTR), are screaming higher. Meanwhile, value names like Proctor & Gamble (PG), ExxonMobil (XOM), and Berkshire Hathaway (BRK/B) can’t seem to gain any traction.

Indeed, the performance of the S&P 500 Growth ETF (SPYG) so far in 2025 is more than double the return of the S&P 500 Value ETF (SPYV). SPYG is up 9% year-to-date versus the 3.75% return on SPYV.

Now though, we’ve reached the point in the market cycle where value stocks need to rally to catch up to the growth names, or the growth stocks need to decline to match the value stocks.

Or… some combination of the two.

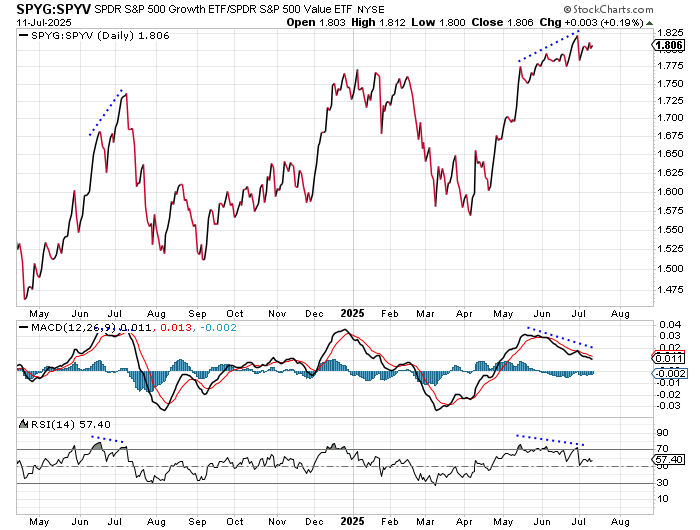

Look at this ratio chart comparing SPYG to SPYV…

When this chart is moving higher, it indicates growth stocks are outperforming value stocks. When the chart is moving lower, value is beating growth.

Growth has been firmly in control since the Liberation Day bottom in early April. And, the outperformance of growth over value has reached extreme levels we haven’t seen since this time last year.

Long-time readers might remember I pointed out that condition last July – just before the S&P 500 tumbled 8% in three weeks, and growth stocks took the biggest hit.

We have the same set up today.

The ratio chart is even higher than it was last year. And, the momentum indicators at the bottom of the chart have been lagging the recent rally. While the ratio chart has made higher highs, the indicators are making lower highs.

This sort of “negative divergence” is often an early warning sign of an impending decline.

The proverbial rubber band for the growth sector is overstretched to the upside. It’s vulnerable to a decline. And, the value stock rubber band is overstretched to the downside. It’s set up for a rally.

This means the leading stocks so far in 2025 are likely to struggle for the next several weeks, and perhaps through the end of the year. The lagging stocks are set to play one heck of a game of “catch-up.”

Based on how the chart looks, that game should begin soon.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.