Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

What If the Fed Cuts, But Interest Rates Go Up Anyway?

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Markets celebrated last Friday when Federal Reserve Chief Jerome Powell hinted at cutting short term interest rates at the Fed’s next policy meeting in September.

If so, that would be the first rate cut since last year, when the Fed went on a prolonged monetary policy hold, keeping short term rates unchanged for the past nine months.

Some folks, including those in the White House, think lowering interest rates is long overdue. But sometimes you should be careful what you wish for.

What happens if the Fed follows through with cuts to the Fed funds rate… but longer-term interest rates go up, instead of down?

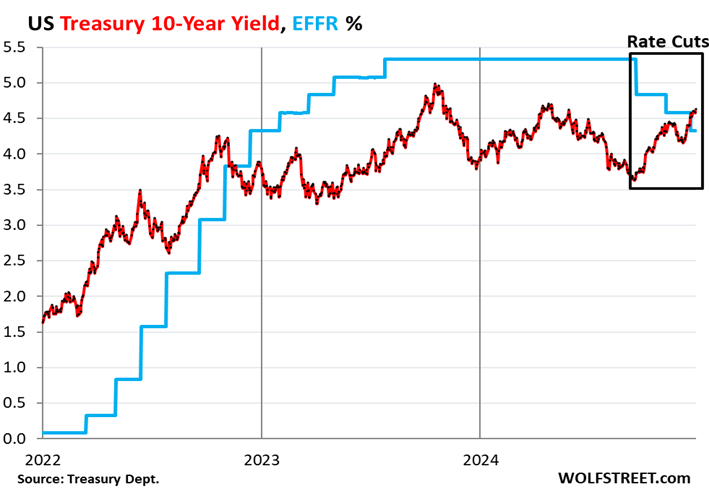

In fact, that’s exactly what happened last time the Fed cut rates several times in 2024, as you can see above. Powell & Co. lowered the Fed funds rate by one full percent.

But rather than declining, 10-Year Treasury yields moved up one percent, making the yield curve even steeper.

That’s an unusual response, unless financial markets are more worried about inflation increasing than they are about growth slowing. That proved to be the case last year, and it could very well be the same this time around, too.

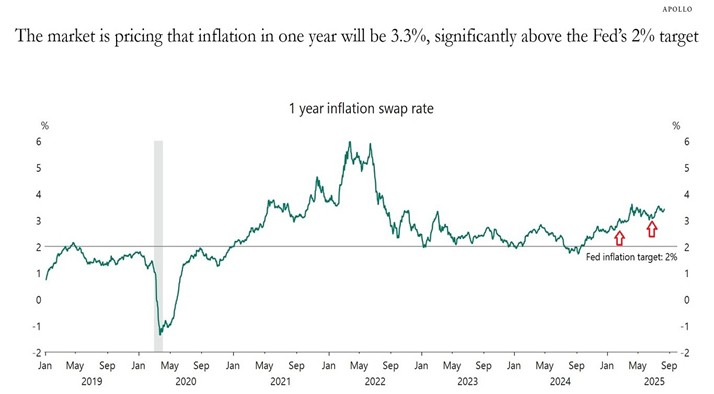

The big reason why the yield curve may be steepening – with long term rates going up even as the Fed cuts short rates – is because the Fed may appear to be caving in to political pressure.

If lower rates spark higher inflation, especially with tariffs already pressuring prices higher, then the market may very well give a vote of no confidence in the Fed and the administration’s tactics. In fact, we already see this playing out in higher inflation expectations, as shown above.

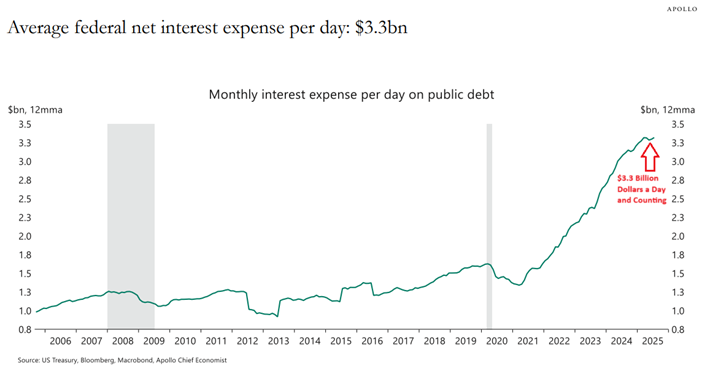

The real elephant in the room here is that U.S. government finances are on an unsustainable path.

Treasury is paying net interest expense of $3.3 billion a day and rising fast.

That’s over $1 trillion in debt service cost every year and growing.

The interest expense paid to foreign debt holders alone is nearly $250 billion and counting.

Bottom line: The Fed can cut short rates all it wants. And stocks will undoubtedly respond favorably, at least at first. But politicizing the Fed’s independence at a time when cost pressure is already on the rise from tariffs is a recipe for inflation, or worse, stagflation. Higher long-term interest rates could easily push already precarious government finances over the edge with an unsustainable increase in debt service costs. And that’s a recipe for higher interest rates in the long run.

Good investing,

Mike Burnick

Contributing Editor, Market Minute